2A Firearms Friendly Merchant Service Provider

5 Star Rated by our Firearms Industry Customers

In business since 2002, providing exceptional service and solutions to the small/medium business community. We are a 2A-friendly merchant services provider that understands the unique challenges and regulations of the firearms industry. We offer a wide range of payment processing solutions to firearms and associated businesses of all sizes. We are committed to providing our merchants with the tools and support they need to succeed.

As a 2A-friendly merchant services provider committed to supporting the firearms community, we offer our merchants competitive rates and fees and provide them with the highest level of customer service available.

We offer a variety of payment processing options.

Basic Services:

- In-store credit card processing

- Online website processing credit card processing

- Mobile credit card processing

- E-commerce payment processing

- Gift card processing

- ACH processing

- Text-to-pay

- Email invoices for payment

Value-added services:

- Online fraud prevention tools to mitigate fraud

- Chargeback protection and response system

- PCI compliance protection and assistance

- Recurring billing

- Exceptional customer support from here in the USA

We are Gun-Friendly for a Reason

Because the management team and many employees at Elite Merchant Solutions are gun enthusiasts, we were concerned with the problems the firearms industry has been experiencing. We have made it our charter to extend our philosophy of providing unbeatable rates to the firearms industry, ensuring FFLs not only save money right away but keep saving it year after year.

We have long-standing and established relationships with private and 2A-friendly banks, giving you the confidence that you have partnered with a Merchant service provider that is familiar with and looking out for the firearms industry.

We see more and more banks and merchant service providers choosing not to work with firearms and related businesses. The ones that offer services will label firearms and associated businesses as “high risk” to justify a higher rate than the typical merchant would receive, all the while claiming to be “firearms friendly.”

At Elite Merchant Solutions, we have a clear advantage over other merchant services providers: we don’t process firearms merchants, including Title II/Class 3 and manufacturers, as high risk.

Frequently Asked Questions

Why Choose Elite Merchant Solutions?

1. We are a 2A-friendly merchant services provider. Unlike the big banks and large payment processors, we are proud to support FFLs and all the associated types of businesses

2. We offer products and solutions that your business needs. Payment processing solutions, integration tools, and products, including financing products that support your business.

3. Elite employs firearms enthusiasts and advocates; our team specializes in understanding the unique challenges and regulations of the firearms industry.

4. Best Price Guarantee. We offer competitive rates and fees, and we so are confident that we can save you money, we guarantee it. If we can’t save you money, we will give you a $500 Gift Card.

5. Support here in the USA. We are a local company based in the USA; our team provides our merchants with the highest level of customer service.

Don’t just take our word for it; read what our customers say!

Why is Elite Merchant Solutions different from other merchant service providers?

Here are the five main reasons:

1. As a company, we believe in and 100% support our 2nd Amendment rights.

2. We specialize in providing gun-friendly credit card processing to online-only, brick-and-mortar, and omnichannel FFLs of all sizes.

3. We work exclusively with private and 2nd Amendment-friendly banks, which enables us to provide the most reliable credit card processing solutions in the firearms industry.

4. We work with gun-friendly credit card processors to ensure that we can provide a payment processing solution for every FFL and associated industry customers.

5. We offer competitive rates, exceptional customer support, and easy integrations with firearm industry software and retail platforms.

What are the types of firearms industry businesses that Elite Merchant Solutions accepts as clients?

We provide merchant accounts for all types of firearm industry businesses, including businesses considered “high risk” by other merchant services providers. We often provide services for companies that the big banks reject for “political” or ideological reasons. Our clients include local gun shops, gun and ammo retailers, sporting goods stores, shooting ranges, manufacturers of related accessory products, and specialty shops supporting the gun industry. Whether the business is a physical retail store, a manufacturing warehouse, an online business, or any combination, we have products and services to help your business with payment processing.

Do I need an FFL to obtain a merchant account?

Yes, if you are selling firearms. We provide services to a wide range of gun and firearm-related industry customers. If you sell firearms, you need a valid or pending FFL to accept credit and debit card payments. Ammunition and accessories sellers do not typically require a license.

Do I need a firearm-friendly payment processor to sell ammo?

Yes, businesses that sell ammunition have the same hurdles that other firearms dealers have processing credit and debit card payments. Those hurdles are solved by partnering with Elite Merchant Solutions.

How do I apply for a merchant account?

To apply, first, you need to complete the online application (which takes about five minutes) and upload any additional required documents (if you are selling firearms, you will need a valid or pending FFL). You will also be asked to provide a copy of your existing merchant services statement or estimate your average monthly sales volume with a breakdown by transaction type (e.g., e-commerce vs. phone order)

What and how long is the Application Process?

Our application process is as easy as 1-2-3; you’ll be accepting payments before you know it.

1. Contact us by phone or online you will be assigned to a 2A dedicated account executive. They will walk you through the online application process (it takes just a few minutes).

2. Provide us a copy of your current merchant statement, and within hours, you’ll receive a written quote with our pricing and terms.

3. Once you sign the application, sit back, relax, and let the Elite team do all the work for you. We make it a quick and easy process the way it should be!

How long does it take until I get approved for my merchant account?

Once you apply, your merchant account will be pre-approved within 24 hours and fully approved (through underwriting) within three to five business days. Be assured that we will work diligently to get your account approved in a very timely manner. We aim to get your merchant account up and running as quickly as possible.

What is a “rolling reserve”?

A rolling reserve requires a percentage of the credit card volume processed (typically 5-10%) to be held in reserve. A rolling reserve is protection for the merchant account and bank from chargebacks. Typically, held funds are gradually released from the reserve after six to 12 months of consistent processing with low chargebacks.

Does Elite Merchant Solutions require a “rolling reserve”?

Sometimes, depending on business history and the type of business, we may require a rolling reserve to be established in order to obtain initial approval. This can be reconsidered after the company has established a positive processing history with the bank.

How do you prevent chargeback problems?

You can avoid excessive chargebacks on your merchant account by documenting transactions well and explaining any terms and conditions clearly. If you are shipping items, be sure to have the tracking details of the transaction in the files as well as all the details you collect about your customer showing it was a legitimate transaction. Being diligent about records helps protect your business and the people who have had their credit card numbers stolen. For online, you can add a few more protection tools that we assist with to mitigate online fraud, as most companies don’t know about these extra features.

Can you dispute a chargeback?

Yes, if you do get a chargeback, you will have a chance to dispute it and respond with all of the details showing that you did everything to ensure it was a legitimate transaction. Plus, with our exclusive system, you can also handle your chargeback before it even becomes a chargeback. That is what sets up apart.

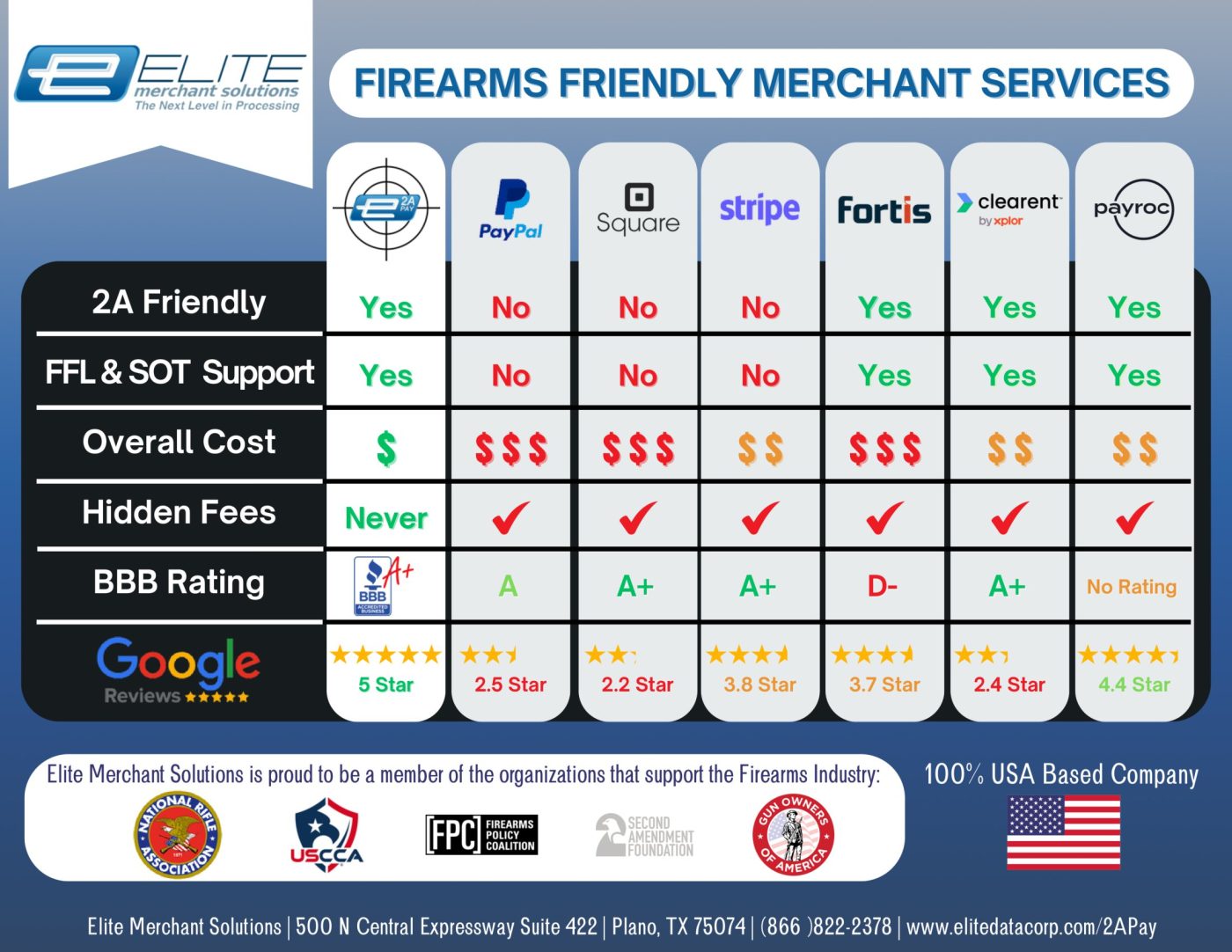

Aren’t all Merchant service providers basically the same?

No, in fact, many of the largest payment processors actually specify in their legal terms they will not support the firearms industry.

The big three (Paypal, Stripe, and Square) won’t open a firearm merchant account because they consider the industry too “high risk.” For example, here’s the language that bans firearm sales from the three most popular online credit card solutions:

“You may not use the PayPal service for activities that: …violate any law, statute, ordinance or regulation that relates to transactions involving … ammunition, firearms, or certain firearm parts or accessories, or (k) certain weapons or knives regulated under applicable law.“ (PayPal Acceptable Use Policy)

Terms of Service restrictions… “use the Services for the sale of firearms, firearm parts, ammunition, weapons or other devices designed to cause physical harm.” (Square terms)

Terms of Service restrictions… “Firearms, explosives, and dangerous materials: Guns, gunpowders, ammunitions, weapons, fireworks, and other explosives…” (Stripe terms)

Some “anti-gun” banks and credit card processors have issues with non-firearm shooting-related accessories (such as holsters). Regardless, even if some of the accessories you sell are allowed by a company, it makes much more sense to have only one credit card processor for ALL transactions.

Then, there are the companies that will open up a high-risk merchant account, but the costs are typically too high to make sense for most firearms retailers. While many companies promote themselves as “high-risk friendly,” they charge companies that would fall into the high-risk category a premium, which means their costs are higher than merchants in other industries.

Merchant Services Terms and Definitions

Chargeback – A chargeback is when a customer files a dispute with their credit card company about the transaction – typically because of fraud, unauthorized transactions, or failure to refund money. Obviously, these are not good for your business.

E-Commerce – Making sales in your gun shop is great, but to be competitive in this market, you’ll need to strongly consider online sales (e-commerce).

Financial Institution/Bank – Firearm retailers will, of course, need a bank. You will need to make sure that your bank allows business accounts for gun merchants.

Payment Gateway – Firearms merchants will also need a payment gateway to accept credit cards. The gateway is the company that handles the transaction through your e-commerce platform or in-store POS system. They are the bridge (or gateway) between your customer’s credit card and the payment processor (merchant account). Elite Merchant Solutions will help you set up the right option for you.

The gateway gathers the credit card details for the transaction, the payment processor runs the credit card, receives the money, and then deposits the money you earned into your financial institution.

Payment Processor – The payment processor is the company that actually processes the credit card transaction. This company is sometimes referred to as a merchant account provider, payment processor, or merchant service provider, and they offer payment solutions as a service.

PCI Compliance – To accept credit cards in the United States, you need to comply with federal laws and help to ensure that you are properly protecting your customers’ credit card information. PCI compliance refers to following all of these rules. Elite Merchant Solutions will help walk you through the process to ensure that you are PCI compliant.

If you don’t have this setup within the first few months of accepting credit cards, you can be charged a non-compliance fee.

Customer Testimonials

Types of Businesses Supported

Ammunition Retailers

Ammunition Retailers Armslist

Armslist CCW Classes

CCW Classes Components & Accessories

Components & Accessories Custom Accessories

Custom Accessories Firearms Courses, Classes & Training

Firearms Courses, Classes & Training Firearms Lifestyle & Apparel

Firearms Lifestyle & Apparel

Gun Shops

Gun Shops GunBrokers

GunBrokers Military & Tactical Gear

Military & Tactical Gear Online Firearm Dealers

Online Firearm Dealers Online Ammunition Dealers

Online Ammunition Dealers Pawn Shops

Pawn Shops Patriot Products & Apparel

Patriot Products & Apparel Shooting Ranges

Shooting Ranges